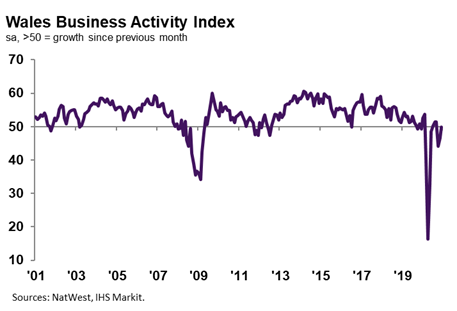

Welsh business activity broadly stabilises at the end of 2020

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 49.9 in December, up from 46.6 in November, to signal broadly unchanged output levels across the Welsh private sector. Where an increase in activity was noted, some firms linked this to a post-circuit breaker lockdown boost in demand. That said, others stated that ongoing restrictions continued to stymie any growth opportunities.

Welsh private sector firms signalled a renewed and solid rise in new business at the end of 2020. The upturn was linked to stronger client demand, with some noting stockpiling among clients before Brexit. The expansion contrasted with the UK average which signalled a fractional decline in new orders. Of the 12 monitored UK areas, Wales indicated the second-fastest rise in new business (behind Yorkshire & Humber).

Welsh companies registered a stronger degree of optimism regarding the outlook for output over the coming year in December. The uptick in confidence was reportedly due to hopes that the COVID-19 pandemic will be controlled over the coming year and an economic recovery will begin. The level of positive sentiment was the strongest since April 2014 and slightly greater than the UK average.

Welsh private sector firms signalled another monthly decline in workforce numbers in December. The decrease in employment was reportedly due to cost-cutting measures and redundancies. While the rate of job shedding eased to the slowest in the current ten-month sequence of reduction, it was quicker than the UK average.

The level of outstanding business fell for the second successive month at the end of 2020. The solid decrease in backlogs of work was quicker than both the long-run series average and the UK trend. The depletion was attributed by firms to historically weak inflows of new orders.

Private sector firms operating in Wales registered an acceleration in the rate of input price inflation in December. The pace of increase was the fastest since August 2018 and marked overall. Higher supplier prices were often linked to raw material shortages and greater freight costs due to shipping issues. The rate of cost inflation was quicker than the UK average.

Average output charges continued to rise across the Welsh private sector at the end of 2020. Firms commonly attributed higher selling prices to the pass-through of greater cost burdens to clients. The rate of inflation quickened from that seen in November, but was only modest overall and slower than the long-run series average. The pace of increase was, however, faster than the trend seen across the UK as a whole.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh private sector firms registered broadly stable output levels in December, following the end of the circuit breaker lockdown in November. There was a boost to sales as new order inflows rose for the first time since September. Although still apprehensive in expanding their workforce numbers due to cost-cutting efforts and short-term COVID-19 uncertainty, business confidence regarding the year ahead outlook improved.

“The impact of the pandemic on supply chains remained evident, however, as greater freight costs and raw material shortages pushed input costs up markedly. Although firms largely raised their selling prices, the pace of increase in input prices outpaced that of charges.”