Mortgage Amounts Increasing Due to Climate Change Concerns – and Cardiff residents could be impacted

Rising sea levels and increased rainfall are causing higher deposit rates in high-risk areas.

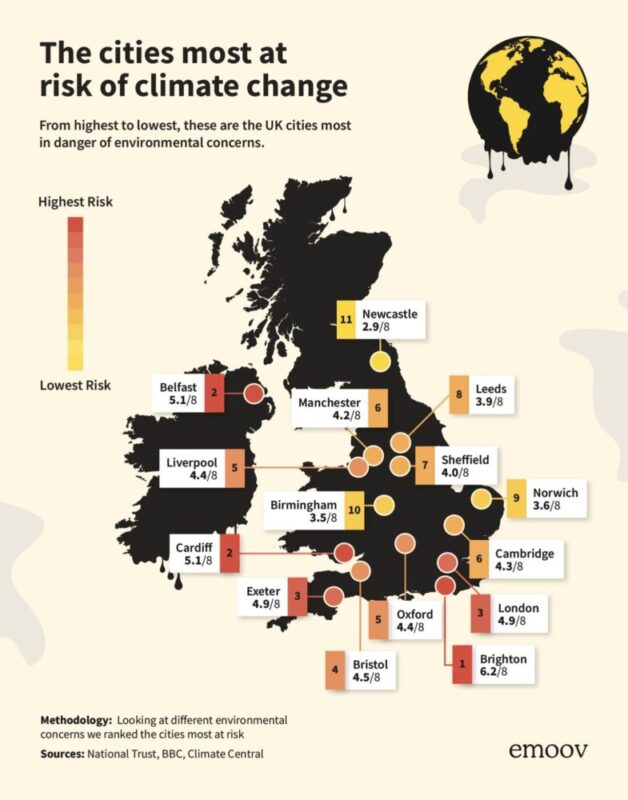

Research from online estate agents Emoov have revealed the cities most at risk of climate change and increased premiums, using National Trust, BBC and Climate Central data, with Brighton, Belfast, Cardiff and London some of the cities in jeopardy.

The cities were scored on:

The cities were scored on:

-

Overheating and humidity

-

Storm damage

-

Expected temperature rise

-

Rainy days

-

Rainfall amount

-

Soil heave

-

Slope factors

-

Part of the city underwater by 2100

Factors such as high winds and flooding are contributing to insurance companies upping their premiums and cautious mortgage lenders revising their loan to value amounts, with high-risk areas seeing rates climb the quickest.

Naveen Jaspal, COO of Emoov said: “Climate change largely affects home insurance and mortgage lending. With the increased likelihood of flooding or high winds, insurance companies have to increase their premiums on properties within high risk flood areas. In turn, these higher premiums will decrease the likelihood of getting a mortgage on these properties.

Properties that are likely to become damaged will cause major uncertainty for mortgage lenders. The knock on effect will be much higher deposits and lower loan-to-value ratios in these areas, this is a problem, as due to climate change, we are seeing these high-risk areas expanding.”