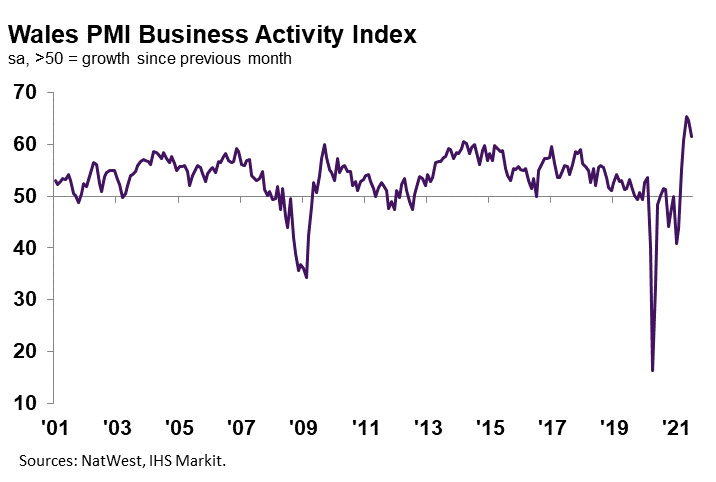

Marked expansion in Welsh business activity in July, higher than the UK average

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 61.4 in July, down from 64.7 in June, but nonetheless signalled the third-fastest rise in activity on record. The rate of expansion was quicker than the UK average, as Welsh firms linked the upturn in output to a sustained rise in client demand and the relaxation of some COVID-19 restrictions.

Private sector firms in Wales signalled a marked expansion in new business at the start of the third quarter. Anecdotal evidence suggested the rise in new orders was due to the relaxation of some COVID-19 restrictions and a boost to client demand. The rate of increase softened, however, to the slowest for three months despite being the quickest of the 12 monitored UK areas.

July data indicated continued upbeat expectations among Welsh private sector firms regarding the outlook for output over the coming year. Optimism reportedly stemmed from hopes that the final easing of lockdown measures will be the end of restrictions, and a further boost to sales. The degree of confidence slipped to the lowest since October 2020 amid some concerns regarding labour shortages.

The level of positive sentiment was below the UK average, however, Welsh private sector firms signalled a sharp rise in workforce numbers during July. Although the pace of job creation softened from that seen in June, it was the second-fastest since February 2017. A number of firms suggested that additional employment stemmed from a further marked increase in new business.

Private sector firms in Wales registered a fifth successive monthly rise in outstanding business at the start of the third quarter. The rate of backlog accumulation was the second-fastest on record and marked overall. Moreover, the rise in incomplete business was the quickest of the 12 monitored UK areas. Some companies noted that greater backlogs of work were due to staff and material shortages, which added pressure to capacity.

Welsh private sector firms indicated another acceleration in cost inflation during July. The rate of increase was the fastest on record (since January 2001) and one of the quickest of the 12 monitored UK regions. Higher cost burdens were commonly attributed to greater material prices and wage bills amid shortages.

July data signalled a substantial increase in output charges across the Welsh private sector. The rate of inflation accelerated again to the fastest since data collection for the series began in January 2001. Welsh firms registered the third-fastest rise in selling prices of the 12 monitored UK areas.

Where increases were reported, companies linked this to the pass-through of higher costs to clients.

Kevin Morgan, NatWest Wales Regional Board, explains:

“Welsh firms recorded another marked expansion in business activity during July, as the relaxation of some COVID-19 restrictions supported demand. Although the rate of output growth slowed slightly, it exceeded the record prior to May 2021. In fact, firms hope that sales will be boosted again when all restrictions are eased. That said, substantial increases in demand also put greater pressure on capacity, as reports of labour shortages exacerbated material delivery delays.

“Concerns regarding inflationary pressures remained in July, as the rate of increase in costs soared once again to hit a fresh record pace. Higher input prices were partly passed on to clients, where possible, as firms sought to protect margins.”