Home sales in Wales pick up despite interest rate hike

RICS UK Residential Market Survey, Wales – February 2022

Sales of homes in Wales strengthened in February, thanks in part to renewed interest from new buyers despite the Bank of England’s decision to increase interest rates – this according to experts responding to the latest RICS Residential Market Survey.

A net balance of +17% of respondents in Wales said they had seen a jump in new buyer enquiries – the second time in a row an increase has been reported. At the same time the number of agreed sales improved, with a net balance of +21% saying sales of homes were increasing and strongest reading since June 2021.

Looking to the next three months, sales are predicted to increase, with a net balance of +22%. Looking further ahead, respondents remained positive with sales expected to remain on a upward trajectory over the coming year.

Declining new sales instructions coming onto the market also appeared to stabilise somewhat in February, with only -10% of respondents saying they had seen a fall.

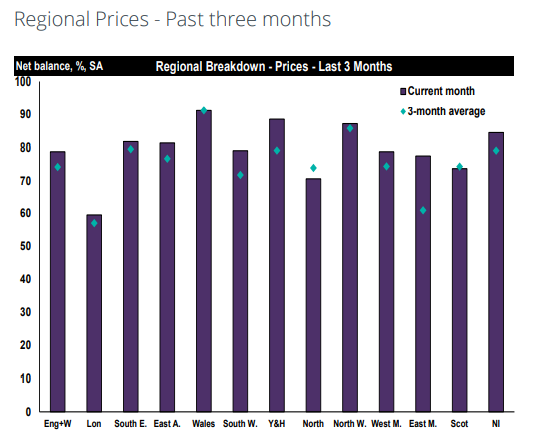

The pace of house price growth has again accelerated according to respondents. A net balance of +91% of respondents in Wales said prices had increased, one of the most elevated levels in the UK.

Unsurprisingly, respondents said they see house prices rising further across the next three and twelve months.

Commenting, in the survey, Andrew Morgan FRICS of Morgan & Davies, in Lampeter said: “There are fewer propoerties available than usual. We are watching world events carefully as these may well have a bearing on people deciding whether or not to move.”

David James FRICS of James Dean in Brecon, said: “There is still plenty of demand and some properties are selling for more than their asking price”.

Commenting on the UK picture, Simon Rubinsohn, RICS Chief Economist, said:

“Huge clouds of uncertainty hang over the economic prospects as energy prices continue to surge and the Bank of England grapples with how to manage monetary policy in this challenging environment.

“Despite all of this, there is little evidence yet that the mood music regarding the expectations for house prices or rents is shifting. Indeed, the medium-term projections from respondents to the RICS survey are continuing to gain momentum.

“It may well be that these trends ease as the deteriorating macro environment begins to bite but the message that keeps recurring, both for sales and lettings, is there are in aggregate many more prospective purchasers and renters than properties available. The risk is that these imbalances exacerbate the cost-of-living crisis and the challenges particularly for those on lower incomes.”