Signs of more activity in Wesh housing market but economic concerns continue to weigh on short-term sentiment

RICS Residential Market Survey Wales – April 2025

There were signs of more activity in the Welsh housing market during April, according to the latest Royal Institution of Chartered Surveyors (RICS) Residential Market Survey. But short-term expectations are less positive with global economic concerns continuing to weight on the outlook.

The survey’s net balances for new buyer enquiries and newly agreed sales in Wales both edged into positive territory for the first time in three months, though only just. More properties were also reported to have come onto the market, giving potential buyers greater choice.

Welsh surveyors are though cautious about the outlook for both house prices and house sales.

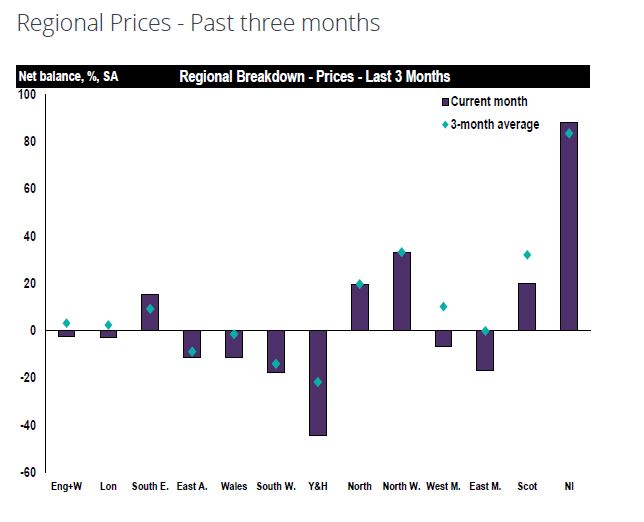

A net balance of -15% of respondents was reported for house price expectations over the next three months and a net balance of -34% was reported for sales expectations. This cautious tone is consistent with the current price balance, with the balance of respondents (-45%) indicating that prices were lower over the past three months.

A net balance of -15% of respondents was reported for house price expectations over the next three months and a net balance of -34% was reported for sales expectations. This cautious tone is consistent with the current price balance, with the balance of respondents (-45%) indicating that prices were lower over the past three months.

Longer-term, sentiment is less negative. Indeed, Welsh respondents expect house prices to rise over the 12 months ahead, with a net balance of 50% expecting prices to be higher in a year’s time.

With regard to the lettings market, a net balance of 18% of respondents in Wales reported a rise in tenant demand in the April survey, whilst -52% reported a fall in landlord instructions. A net balance of 30% of Welsh surveyors expect rents to rise over the next three months.

Commenting on the sales market, Anthony Filice, FRICS of Kelvin Francis Ltd in Cardiff said: “There are a high level of new listings as we move into Spring and buyers have a good choice. The balance is moving in favour of buyers and the likelihood is that interest rates will fall. Some lenders are reflecting this already. Important that vendors take advice on value to effect an early sale.”

On the lettings market he added: “Those Landlords who are staying in the market are accepting offers on rents, which have been rising, as tenants still have a wide choice, at least in the middle to upper end of the market. At the lower end, many landlords are selling up.”

Commenting on the UK picture, RICS Chief Economist Simon Rubinsohn said:

“Although geopolitical developments haven’t helped the mood music in the residential market over the past month, the main reason for the dip in the key RICS sales activity metrics lies in the expiry of the stamp duty holiday at the end of March. Near term expectations indicators suggest the subdued trend will persist for the next few months at least but looking beyond this, the results are more encouraging reflecting in part the prospect of deeper interest rate cuts than previously anticipated.

“More problematic, however, is the negative feedback in the survey around supply in the rental market. With demand continuing to grow, there appears little relief in store for tenants in terms of the upward pressure on rents. Critically, even with the rise in the build to rent to sector the shortall of affordable rental stock looks set to remain substantial”.

—

About the data

- Net balance = Proportion of respondents reporting a rise in prices minus those reporting a fall (if 30% reported a rise and 5% reported a fall, the net balance will be 25%)

- Net balance data is opinion based; it does not quantify actual changes in an underlying variable

- A positive net balance implies that more respondents are seeing increases than decreases (in the underlying variable), a negative net balance implies that more respondents are seeing decreases than increases and a zero net balance implies an equal number of respondents are seeing increases and decreases

The RICS Residential Market Survey is released on the second Thursday of every month apart from January.

About RICS

We are RICS. Everything we do is designed to effect positive change in the built and natural environments. Through our respected global standards, leading professional progression and our trusted data and insight, we promote and enforce the highest professional standards in the development and management of land, real estate, construction and infrastructure.

Our work with others provides a foundation for confident markets, pioneers better places to live and work and is a force for positive social impact.