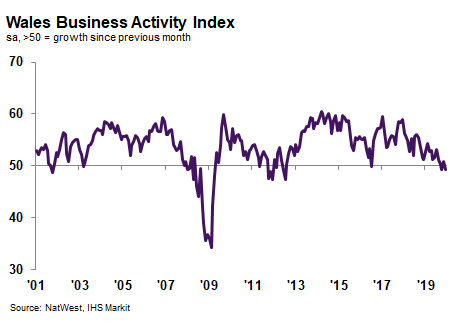

Renewed fall in Welsh business activity in December

According to the latest NatWest Wales PMI® data, private sector firms indicated a renewed fall in output during December. The decrease in activity was linked to a further drop in client demand, with firms reducing their workforce numbers for the sixth month running.

Nonetheless, the outlook for output over the coming year improved, as optimism improved to the strongest since July.

On the price front, the rate of output charge inflation softened to a marginal pace, despite a marked rise in cost burdens.

The headline Wales Business Activity Index – a seasonally adjusted index that measures the combined output of the manufacturing and service sectors – registered 49.3 in December, down from 50.8 in November, to signal a marginal decline in business activity across the Welsh private sector. The rate of contraction was in line with that seen across the UK as a whole. Local firms linked the fall to a further downturn in new order inflows.

December data indicated a fifth successive decrease in new business across the Welsh private sector. The rate of decline softened, however, and was only fractional overall. Companies stated that there were signs of domestic demand starting to pick-up.

That said, the trend in Wales contrasted with that seen at the UK level, where a fractional expansion was recorded.

Backlogs of work continued to decline at the end of 2019, with the rate of depletion remaining solid, despite easing to the weakest in three months. Panellists suggested that spare capacity was due to a sustained drop in client demand.

In contrast with the trend seen across the UK as a whole, Welsh private sector firms registered a further fall in workforce numbers at the end of the year. Lower staffing levels were reportedly due to the non-replacement of voluntary leavers.

Input costs continued to increase in December, with inflation quickening to a marked pace that was the fastest since June. The rate of increase was the joint-sharpest of the 12 monitored UK areas, with many local firms linking this to higher supplier prices.

Despite the faster rise in costs, the rate of increase in selling prices moderated and was among the slowest in four years. Service providers registered a slower rise in charges than manufacturers.

Finally, output expectations for the coming year improved in December, with the degree of optimism reaching the highest since July. That said, Welsh companies were among the least optimistic of the 12 monitored UK areas.

Kevin Morgan, NatWest Wales Regional Board, said:

“The final month of 2019 brought a renewed fall in business activity across the Welsh private sector, stemming from a further contraction in new orders and muted client demand. Although mirroring the output trend seen across most parts of the UK and local firms recording the highest business confidence for five months, Welsh companies were among the least confident of an increase in activity over the next year of the 12 monitored UK areas.

“Worryingly, employment continued to decline on the back of another reduction in new order inflows. Lower payroll numbers did not stymie a pick-up in cost pressures, however, as input prices rose at the fastest rate since June. Lacklustre demand meant that companies struggled to pass on additional cost burdens, with selling prices increasing only marginally.”