Business activity continues to fall in Wales amid weak demand conditions

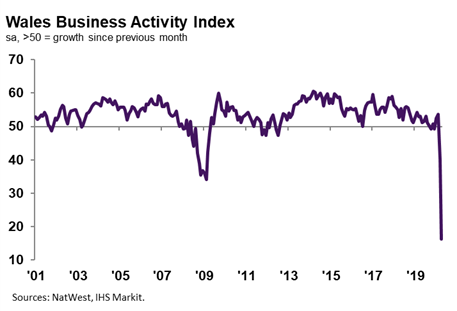

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 48.4 in June, up notably from 32.7 in May, to signal a marginal contraction in business activity. The slower fall indicated a move towards stabilisation in output, although ongoing lockdown measures reportedly stymied growth opportunities. The rate of decline was much slower than April’s nadir and was the softest in the current four-month sequence of contraction.

Welsh private sector firms registered a strong, albeit notably softer, fall in new orders at the end of the second quarter. Although some firms noted an uptick in new work due to the reopening of businesses, many stated that ongoing lockdown measures had stifled growth, with many customers still closed. The drop in new orders was slightly quicker than the UK average, despite easing.

Manufacturers and service providers both recorded downturns in new business, with service sector firms noting a more severe decrease.

June data indicated a rise in business optimism among Welsh private sector firms. Higher positive sentiment was commonly linked to hopes that demand conditions will improve following the easing of restrictions. The degree of confidence was well above the series average, and was the strongest of the 12 monitored areas.

Welsh manufacturers and service providers continued to register lower workforce numbers in June, as weak client demand weighed on hiring decisions. Panellists reportedly lowered staffing numbers in an effort to reduce overheads whilst revenues were falling. The rate of contraction in employment outpaced the UK average and was slower than only the North East and London.

The rate of contraction in backlogs of work across the Welsh private sector eased for the second month running in June to the slowest since February. The drop in outstanding business was steep despite being the second-weakest of the 12 monitored UK areas. A number of firms stated that lower new order inflows had enabled them to work through incomplete business.

Input prices faced by Welsh private sector firms rose for the second successive month in June, albeit at only a moderate rate. The uptick in cost burdens was attributed to supplier price hikes following supply chain issues caused by the COVID-19 pandemic. The pace of inflation was slower than the long-run series average, but was the second-fastest of the monitored UK areas (slower than only Northern Ireland).

Average output prices at Welsh private sector firms increased for the first time since February in June, albeit only fractionally. Higher selling prices were largely due to greater charges at manufacturers, with service providers continuing to lower their output prices. Where a rise was reported, firms linked this to the partial pass-through of higher supplier costs to clients.

Kevin Morgan, NatWest Wales Regional Board, commented:

“The Welsh private sector remained in contraction territory in June, as new business continued to fall amid ongoing COVID-19 restrictions. The decline in customer demand was slower than the UK average, however, with business confidence picking up to the highest of the monitored UK areas.

“In an effort to reduce overheads whilst cost burdens rose at a faster pace, firms shed workers at a marked rate. With the exception of the historic lows seen in April and May, the pace of decline was the sharpest since March 2009 and quicker than that seen at the UK level.”