Cardiff benefits from increase in cross-border commercial real estate investment: Knight Frank

Of almost $1 trillion spent on commercial real estate (CRE) globally in the 12 months to Q1 2019, one third involved cross-border investment, with Cardiff set to benefit from the trend.

Canada, the US, Mainland China and Singapore were home to the leading cross-border buyers over this period.

Published this week, Knight Frank’s Active Capital report reveals that a long term lowering of GDP growth and interest rates in a late-cycle environment is encouraging an increase in cross-border capital flows, both to diversify risk and chase enhanced returns.

The report reveals that in the first quarter of 2019, equity funds, investment managers and real estate operating companies were among the most active, investing in assets from offices in Madrid, Spain, to shopping centres in Hong Kong. Examples in Cardiff include the acquisition earlier this year of a building in Cathedral Road by a company backed by Chinese equity.

With private equity investment a leading indicator for cross-border capital flows, Knight Frank’s report reveals that in Q1 2019, Mainland China and Hong Kong absorbed over $5 billion of international private equity capital. According to Knight Frank’s analysis of RCA data, in the same period, Japan received over $1.3 billion into its office and retail markets. Norway and Finland saw $1.7 billion of private equity capital invested, up from $706 million over the full year in 2018. Meanwhile, on the back of tourist flows and city-level economic strength in Italy, private equity funds invested $510 million in hotels and offices across the country during the quarter.

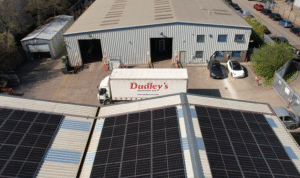

Knight Frank’s research predicts a rotation in private equity real estate fund allocations, from a focus on office and retail assets, towards greater weightings in industrial and specialist sectors. By 2023, industrial assets could account for as much as 20% of such portfolios, and specialist sectors (which include student housing, co-living, and healthcare, amongst others) up to 50%.

Gareth Lloyd, Partner Cardiff Capital Markets at Knight Frank, said:

“There remains a strong case for investing in real estate as an asset class, especially in this lower-for-longer environment, where it can provide a mix of relative stability and income versus equities and bonds. However, investors must consider their risk exposure and identify ways to find return without simply moving up the risk curve.

“Uncertainty over the position of the real estate cycle and the outlook for returns is encouraging investors to target different types of real estate exposure, including specialist sectors, such as senior living, healthcare and PRS.

“Cardiff, is well placed to benefit from this cross-border investment. The city has really elevated itself in recent years and is increasingly being targeted by overseas investors. There is particularly strong demand for offices and the specialist sectors such as Hotels, Student Accommodation and Healthcare, where there has been recent new development, and the returns are still relatively attractive compared to London and some of the other major UK Cities.”

In its third year, Active Capital identifies the top ten most likely sources of cross-border capital in 2019, advising that wealth, financial freedom, innovation, tax burden and unemployment contribute to this outlook. These sources are Germany, Japan, Luxembourg, Norway, Qatar, Singapore, Switzerland, Taiwan, United Arab Emirates and the United States.