Electric vehicle enquiries in Wales rise 26% in 2020

New research by MoneySuperMarket reveals that enquiries for Electric Vehicles (EVs) have risen 26% in Wales in 2020.

The data is taken from millions of MoneySuperMarket car insurance enquiries and shows that between July and December 2020, around five out of every 1000 enquiries nationwide were for EVs (0.54%), up from four (0.37%) between January and June.

Key findings for Wales include:

• Average premiums for EVs in Wales were £474.87, 24% lower than the nationwide average of £627.70

• 0.34% of car insurance enquiries in Wales are for electric cars, with London having the highest proportion nationwide (0.86%)

• EVs have the lowest average premiums – nearly £46 cheaper than petrol cars (£673.61) and nearly £60 cheaper than diesel (£682.82)

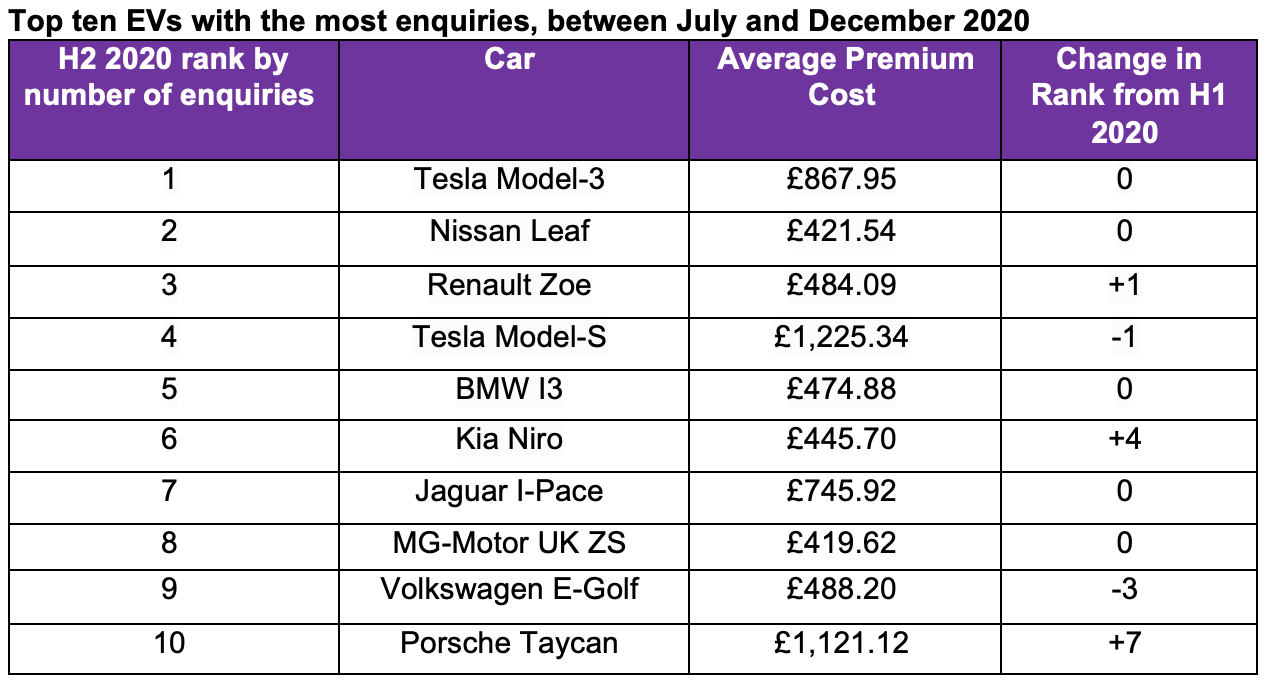

• The Tesla Model-3 is the most popular EV nationwide, following by the Nissan Leaf

The proportion of car insurance enquiries for electric vehicles (EVs) increased by more than two-thirds (69%) in 2020, according to research by MoneySuperMarket.

Data from millions of MoneySuperMarket car insurance enquiries shows that between July and December 2020 around five out of every 1000 enquiries were for EVs (0.54%), up from four (0.37%) between January and June. This represents the sixth successive half-yearly increase and a nearly fourfold rise (284%) on the start of 2018, when only 1 in 1000 enquiries (0.14%) were for EVs.

In London, approximately nine out of every 1000 (0.86%) enquiries were for EVs, the highest proportion in the country. This was up from five out of 1000 (0.54%) in the first six months of the year, a 60% rise and the largest of any region.

The capital is followed by the South East (0.72%) and Scotland (0.57%), with Wales and Northern Ireland having the lowest proportion of enquiries for electric vehicles (both 0.34%).

The average premiums for EVs in London were also over £200 higher than anywhere else in the country, suggesting residents may be opting for higher-end electric cars, which can be more costly to insure.

Overall EVs have the lowest average premiums, when compared to petrol and diesel cars. As of the second half of 2020, an EV cost £627.20 on average to insure – nearly £46 cheaper than petrol cars (£673.61) and nearly £60 cheaper than diesel (£682.82).

Comparing the volume of enquiries, the most popular EV is the Tesla Model-3, with an average premium of £867.95. Comparatively, the Nissan Leaf, which was the most popular EV until the start of 2019, has an average premium of £421.54.

Kate Devine, car insurance expert at MoneySuperMarket, commented: “The 69% rise in the proportion of car insurance enquiries for electric vehicles really shows how popular they are becoming in the UK. The overall proportion may seem small at present, but we expect this trajectory to continue as the range of EVs on the market expands across different price points.

“While the Tesla Model-3 increased the average car insurance cost for electric cars after claiming the top spot from the Nissan Leaf last year, it’s reassuring to see that you don’t have to break the bank to go electric and that there are options at lower prices as well.

“Our advice, whether you’re looking to buy an electric car or not, is to compare the options for car insurance, as this is the best way to find a deal that covers your needs and keeps costs down.”

You can find out more about home electric cars and car insurance via the MoneySuperMarket website.