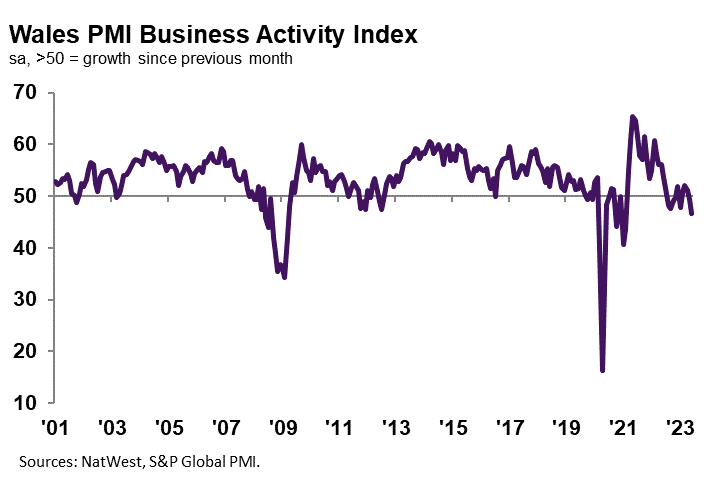

Natwest Wales PMI Reports Fastest fall in Welsh activity since February 2021 amid renewed drop in new orders

Sunset panorama view of Cardiff bay in Wales.

- Decline in new business sparks sharper fall in output

- Inflationary pressures ease

- Employment unchanged on the month

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 46.7 in June, down from 49.4 in May. The latest data signalled a solid contraction in output at Welsh firms, and the fastest fall in activity since February 2021. Economic uncertainty, hesitancy among customers and reports of destocking at clients drove the decline, according to panellists. The decrease in business activity in Wales contrasted with the trend for the UK as a whole, where output rose at a solid pace. In fact, Welsh firms recorded the weakest performance of the 12 monitored UK areas.

Welsh companies registered a return to contraction in new orders during June, following a three-month sequence of expansion. Although only marginal, the rate of decline was the fastest since January. Firms noted that weak client confidence and economic uncertainty weighed on demand, with some also reporting destocking at customers. The fall contrasted with the UK trend, which indicated a modest upturn.

Firms in Wales remained upbeat in their expectations for output over the coming year in June. Optimism reportedly stemmed from efforts to launch new and diverse product ranges, alongside hopes that inflation and economic uncertainty will ease. Nonetheless, the degree of confidence slipped to a four-month low. The level of positive sentiment was broadly in line with that seen across the rest of the UK.

Welsh companies registered no change in employment at the end of the second quarter, following a five-month sequence of contraction. Although some firms noted a rise in staffing numbers, many stated that weak client demand and a drop in new orders led to the non-replacement of voluntary leavers.

Welsh companies were alone out of the 12 monitored UK areas in not recording a rise in employment.

The level of outstanding business at Welsh firms dropped at a marked pace during June. The rate of decline quickened for the fourth month running, and was the sharpest since May 2020. Anecdotal evidence suggested that lower new orders and sufficient capacity led to the substantial fall in backlogs of work.

The rate of contraction was much steeper than the UK average, with manufacturers and services providers in Wales alike registering marked decreases in incomplete business.

Welsh businesses indicated a steep rise in input costs at the end of the second quarter, albeit at a softer rate. Where an increase in operating expenses was noted, firms linked this to some supply issues for specific inputs. That said, the pace of inflation slowed to the weakest since October 2020 as companies stated that lower utility and supplier prices dampened the rise in costs.

With the exception of Northern Ireland, Welsh firms signalled the slowest rise in input prices of the 12 monitored UK areas.

June data signalled a further sharp increase in output charges at Welsh firms. Anecdotal evidence often associated the rise in selling prices with the pass-through of higher costs to customers. Nonetheless, the rate of charge inflation softened to the weakest for over two years. The pace of increase was slightly slower than the UK average.

Inflation was driven by Welsh service sector firms, as manufacturers saw only a modest rise in output prices.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh firms indicated worsening demand conditions in June, as new orders contracted for the first time since February. The fall in new business led to the sharpest drop in output for over two years, while firms left employment unchanged amid subdued sales and a marked decline in work outstanding. Notably, Welsh firms registered the steepest fall in output of the 12 monitored UK areas. Concerns surrounding the stability of demand weighed on business confidence, which slipped to the lowest for four months.

“At the same time, inflationary pressures softened. Rates of increase in input costs and output charges slowed to the weakest since October 2020 and April 2021, respectively, as moderations in energy and supplier prices were passed through to customers amid efforts to remain competitive.”