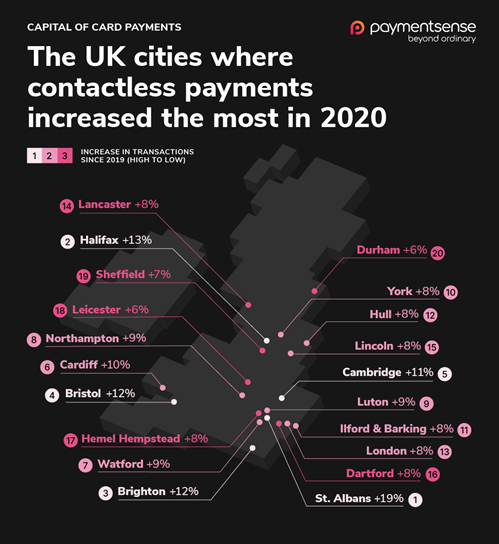

New data reveals Cardiff is expected to be one of the FIRST cashless cities in the UK

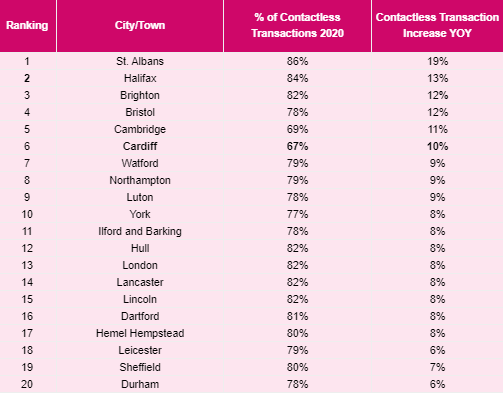

A new report by UK merchant service provider, Paymentsense, reveals that 67% of all transactions are now made via contactless cards in Cardiff. This places the Welsh capital at number six on the list of cities embracing contactless. The top three being Brighton in third place at 82%, behind Halifax in at two with 84%, both of which are behind the leader, St Albans at 86%.

Following a 60% decrease in the use of cash machines in April 2020, Paymentsense analysed their unique data over the last 6 months to find out which UK cities used cash the least.

The data also found which cities preferred contactless and digital payments the most, and which cities had the highest year-on-year (YoY) increase in these payment methods.

The findings have been mapped and the UK’s Capital of Contactless Card payments is ready to be revealed.

Cardiff one of the places leading the way with the sixth-highest % uptake of contactless credit and debit cards

The study reveals that Cardiff is one of the UK’s Card Payment Capitals for an exponential increase in the use of contactless. 67% of payments in Cardiff were made by contactless cards since the Covid-19 pandemic began, with a significant YoY increase of 10%.

St Albans was top with 86% of payments proving contactless (+19% YoY), with Halifax in second, boasting 84% of cash-free transactions (+13% YoY).

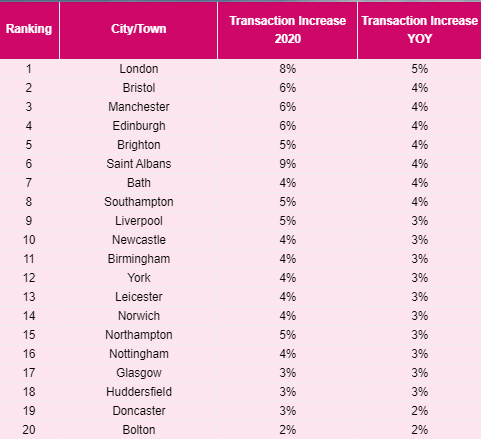

Cardiff residents not as keen on tech-savvy Apple & Google Pay

An overwhelming 79% of Brits are estimated to own a smartphone. So, with Covid causing businesses to refuse cash, digital contactless payment technologies like Apple and Google pay are on the up. Cardiff residents weren’t keen on using their phones to pay, not even ranking in the top twenty. Here, St Albans leads in adoption of Apple/Google pay since the pandemic started in 2020 with a 9% increase in usage over the last six months and +4% between 2019 and 2020.

Durham and Bolton trail behind St Albans and hold on to cash

Durham were still least likely to part with their cold hard cash with only a 6% uplift in contactless payments since 2019. Whilst Bolton natives were less likely to use Google and Apple Pay, accounting for the smallest growth in adoption of contactless payments, just 2% more between 2019 and 2020.

Jon Knott, Head of Customer Insight at Paymentsense said:

“Coronavirus has undoubtedly forced change in our lives and shopping habits. As more businesses refuse cash as a precaution against Covid, it makes perfect sense that the use of contactless cards are on the up this year, more than ever.

Our findings confirm that major cities are transitioning to a cashless society at a rapid pace. However, as we’ve seen with St. Albans it isn’t just the UK’s big cities going cash-free; smaller towns are increasingly choosing contactless methods. With the pandemic ongoing, it seems that a cashless Britain may be here sooner than we thought.”

For more information please see the full campaign page here.