Small businesses in Wales showing ambition to grow but struggling to obtain the right financial backing

Small and medium enterprise (SME) owners in Wales are feeling more optimistic and are keen to invest in growth but are being frustrated by the mix of financial options open to them, according to a survey from ACCA UK (the Association of Chartered Certified Accountants) and The Corporate Finance Network (CFN).

Small businesses in Wales have had a strong return to trading with accountants reporting all clients had found trading levels at or above expected levels, compared to 57% of businesses across the UK.

They have also shown a surge in confidence over the last few weeks, with 60% of SMEs expecting to return to pre-Covid levels of turnover and productivity within a year.

One in five SME business owners in Wales was bringing forward plans to obtain additional finance to invest in their business.

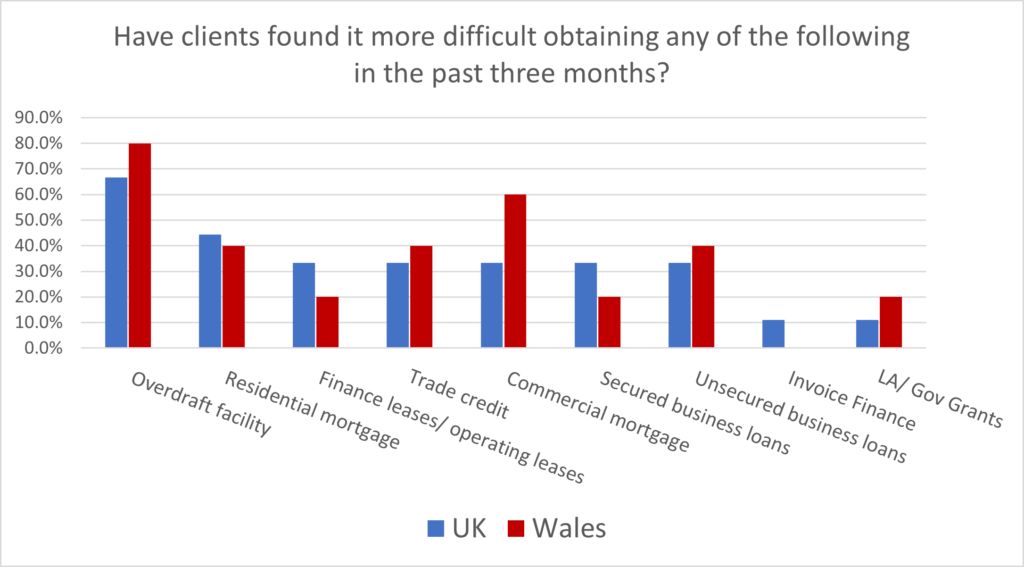

However, this positive energy and ambition is being held back by struggles to find the right mix of financing for success – 80% of accountants in Wales said their clients had found it more difficult to obtain even an overdraft from their bank in recent weeks. Welsh SMEs were almost twice as likely (60%) to be turned down for commercial mortgages than businesses across the UK (33%).

This has led to a spike in mental health problems, as owners are frustrated in their efforts to take advantage of reopening. A worrying 50% report that they are feeling more stressed and anxious, with 5% saying they feel unable to cope.

The difficulties SMEs are facing come at a time when they are desperate to re-establish or grow their operations and put themselves on a solid financial footing for growth. Covid restrictions in Wales are currently at level 1 and are not scheduled to move to level 0, with the ending of most restrictions, until August 7.

Around one-third of SMEs in Wales state they have been positively impacted by Covid, in economic terms, but they are having problems accessing commercial finance facilities to maximise on this success, following the closure of many of the government-backed support schemes and the slow rollout of the Recovery Loan Scheme, which launched in early April 2021.

The SME Tracker, which reports what small businesses tell their accountants, reported data from accountants representing 4,800 SME clients in Wales and ran until July 21.

Lloyd Powell, head of ACCA Wales, said: “Small businesses in Wales are confident and ready to spark economic recovery. They need to be able to access the right financial support, with the help of their accountants and business advisers.

“It’s important that funds continue to be made available to support businesses who remain affected beyond the full reopening date and following the closure of the current Economic Resilience Fund grants in August.

“Business support so far in Wales has been generous, but with many of our SMEs unable to trade fully until at least August, it’s vital that owners are signposted to the finance options available to them apart from traditional sources, such as banks.”

Kirsty McGregor, founder of The Corporate Finance Network, said: “It’s encouraging that businesses are getting back to good levels of trading and want to invest to grow. But it’s important to get the right mix of finance to do this in a sustainable way for the long term.

“We can see that increasing anxiety is leading businesses to take a short-term approach and traditional sources of funding are drying up, particularly for SMEs who have already taken government-backed loans.

“We continue to hear that the uptake of recovery loans is very slow and few of the accredited lenders are making them available. The communications around this scheme have been poor and they seem to have made very little impact since they launched in April.”