Wales’ Highest Credit Scorers Revealed

By Penny Mayes, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=6265045

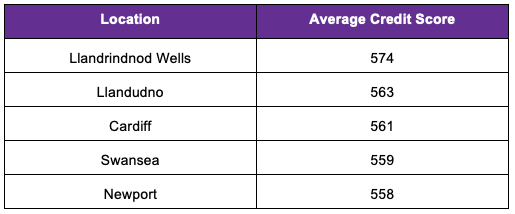

Looking at over 200,000 credit reports from MoneySuperMarket’s Credit Monitor, findings show that those in Llandrindnod Wells have the highest average credit score in Wales at 574 out of a possible 710 – 12 points higher than the UK average (562).

People living in Kingston upon Thames (KT) have the highest average credit scores in the country, according to the UK’s leading price comparison site MoneySuperMarket.

Analysis of over 200,000 credit reports from MoneySuperMarket’s CreditMonitor reveals that those with a KT postcode have the highest average credit score at 586 out of a possible 710 points – 17 points higher than the UK average.

Whilst an individual’s credit score is not only directly influenced by their location alone, there are a number of factors that can affect this. It’s worth considering how long credit has been held, history of payments, creditusage and even registration on the electoral roll that can have a clearer impact, with these factors driving credit score trends across different parts of the country.

According to MoneySuperMarket data, Guildford in Surrey has the second highest average score across the UK at 584, while the UK average score is 569 – an increase of seven points since 2019.

By contrast, those living in parts of the north of England and the midlands have some of the lowest credit scores in the country. Sunderland (552), Doncaster (554) and Wolverhampton (555) are the three lowest scoring postcodes.

Being registered on the electoral roll is a simple way to boost credit score. The average credit score of a person listed on the electoral roll is 573 – 34 points more than those not listed.

Sally Francis-Miles, money spokesperson at MoneySuperMarket, commented: “Although your credit score isn’t directly impacted by your location, our research shows that those with a KT postcode are the top credit scorers in the UK, scoring 17 points higher than the UK average. This means that they are some of the most attractive customers to lenders, as their level of risk is typically less than those with lower scores.

“There are many ways you can boost your score though. The simplest one is ensuring you are registered to vote on the electoral roll. It may not sound that significant, but it can have a huge impact – it confirms your name and address which is essential for lender verification processes can help too, as it shows lenders you are reliable and unlikely to default.

“Additionally, using free-to-use monitoring services, such as MoneySuperMarket’s Credit Monitor can help you keep an eye on your own credit rating and offer personalised tips on how you can increase your score.”

MoneySuperMarket’s top tips for improving your credit rating include:

- Debt repayments – keep on top of repayments for loans, mortgages and credit cards by setting up direct debits where you can. This will ensure you do not miss any payments and avoid any black marks against your name.

- Pay your bills on time – one missed payment can leave a mark on your credit score for some time. To avoid this happening, set up direct debits where possible to ensure you don’t miss a payment by mistake.

- Take out a credit-building credit card – credit-building credit cards have higher than average annual percentage rates (APR) and low credit limits. Although you won’t be able to borrow a large sum of money, if you can afford to keep up the repayments, a credit-building card can help you to increase your credit score over a sustained period of time.

- Close unused accounts – if you have credit cards you no longer need it is important to close them. Having a large credit limit even if it’s not being used will have an impact on your rating. Don’t worry if you see a drop in your credit rating first, this is completely normal.

For more tips and information, visit MoneySuperMarket to see if your area falls into a credit score capital of the UK: https://www.moneysupermarket.com/credit-monitor/credit-score-capital/

Image Credit: By Penny Mayes, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=6265045