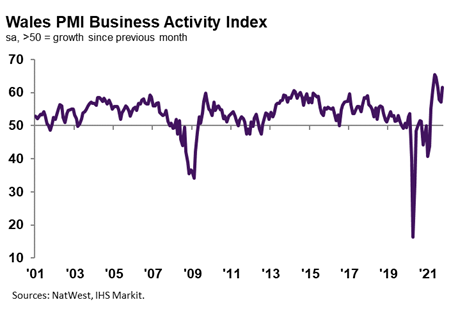

Welsh business activity growth accelerates amid stronger client demand

Key Findings

- Fastest rises in output and new business since June

- Inflationary pressures strengthen

- Backlogs of work increase at quicker pace

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 61.5 in October, up from 57.1 in September, to signal a marked expansion in output. The rise in business activity was the sharpest for four months and the steepest of the 12 monitored UK areas. Anecdotal evidence suggested that the upturn was due to greater client demand and a stronger increase in new business.

Welsh private sector firms indicated a marked rise in new business during October. The pace of expansion accelerated to the sharpest for four months, as firms often noted that strengthening client demand drove growth. Of the 12 monitored UK areas, Welsh firms recorded the steepest upturn in new orders.

Output expectations for the year ahead at Welsh private sector firms remained strongly upbeat at the start of the fourth quarter. Companies stated that optimism was linked to hopes of a further uptick in client demand and stabilisation in supply chains. That said, the degree of confidence dropped to a three-month low, and was below the UK average.

October survey data signalled a strong upturn in Welsh private sector employment. Higher workforce numbers were attributed to greater new order inflows and increased business requirements. Nevertheless, ongoing labour shortages persisted, with firms noting challenges hiring suitable candidates for current vacancies and a high turnover of staff. The rate of job creation eased to the slowest since May and was among the softest of the 12 monitored UK areas.

Welsh private sector firms registered a further marked increase in outstanding business during October. The rate of growth was the fastest for three months and the sharpest of the 12 monitored UK areas. Companies stated that the rise in work-in-hand stemmed from greater new sales and challenges hiring new staff amid labour shortages.

Input costs increased at a substantial pace at the start of the fourth quarter, with the rate of inflation accelerating to a series-record rate. The pace of increase was the second-fastest of the 12 monitored UK areas, behind only Northern Ireland. Companies often noted that higher input prices were due to greater transportation, fuel, wage and raw material costs.

Welsh private sector businesses recorded a marked rise in output prices at the start of the fourth quarter. The rate of inflation accelerated to the fastest in almost 21 years of data collection. In line with the trend for input costs, Welsh firms signalled the second-sharpest increase in charges of the 12 monitored UK areas (slower than only Northern Ireland). Companies attributed the rise in output charges to the pass-through of costs to clients.

Gemma Casey, NatWest Ecosystem Manager for Wales, commented:

“Welsh private sector firms registered a positive start to the fourth quarter with a marked rise in business activity following stronger new order growth and strengthening client demand. As a result, the rise in backlogs of work accelerated at a high pace. That said, the rate of job creation slowed to a five-month low as firms noted that labour shortages hampered companies’ abilities to fill vacancies with suitable candidates.

“Inflationary pressures strengthened as raw material and labour shortages, alongside greater transportation and fuel costs, pushed input prices higher. Encouragingly, firms were able to pass on higher costs to their clients through the fastest rise in charges in almost 21 years of data collection.

“Meanwhile, output expectations remained upbeat with optimism linked to a further uptick in demand and stabilisation in supply chains.”